Innovation – Success or Catastrophe?

Technological Innovation

Many are te studies and news available (Computerwhorld, 2013; McKinsey, 2013; Malta, 2010) that reveal multiple technological innovations with disruptive potential regarding the impact on different industries and on business processes, making those investments be made under penalty of losing competitiveness, or even, putting in question the survival capabilities of a company on a short to medium term.

Being necessary the incorporation of technological innovation, this may, in many situations, bring elevated losses of time and funds, for there is the risk of incorporating technology that is not ready, being capable of delivering the results made by early promises, but with added time and funding. On other cases, the introduction of innovation in organizations may be poorly conducted due to cultural difficulties or internal resistance. These investments may suddenly become inviable or completely eliminate all expected return on investment, hence becoming a competitive disadvantage. On the other hand, organizations that choose not to believe in any innovation of high impact and success may lose definitively the capability to compete, and in a worst case scenario, enter an insolvency situation. For these reasons technological innovation should be pondered and with due fitting within the strategy and the business objectives of every organization, in its processes and be put to the service of the people (Smaczny, 2001).

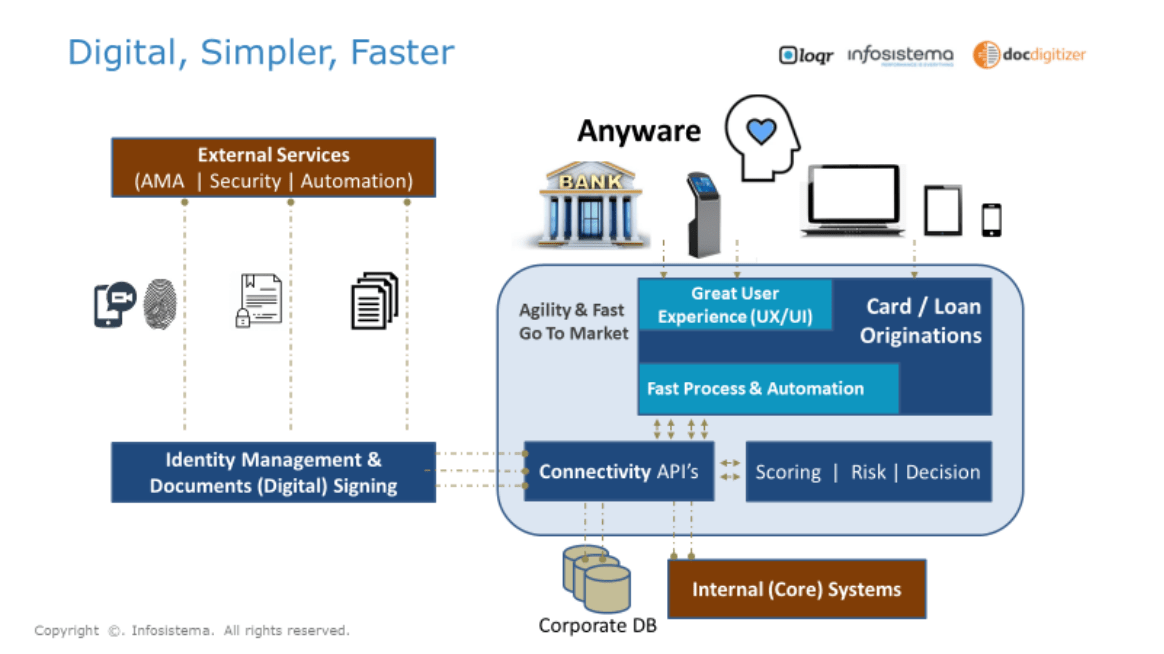

Some perspectives suggest five disruptive technological tendencies such as social networks, cloud based solutions, software as a service (SaaS), technology and solutions available for usage and self-configuration (self-service IT), predictive analysis or payments through mobile services, in accordance to an inquiry made to 221 IT Executives by Computerworld (2013). Some of these tendencies are associated with the so called “third platform” and which will motivate large investments during the next decade are: Mobile; Cloud; Big Data; Social; Internet of Thing and Natural Language (Ogewell et al., 2014; Preimesberger, 2014).

On the financial industry there are still requisites of legal conformity that are imposed by the (Basel-Committee 2006, EIOPA 2009), such as Basel II / III (Banking), and the Solvency II directive (Insurance) that aim at reducing the operational risks of the financial organizations, as well as those of the entire economy. These requisites of conformity imply significant efforts and investments that directly influence the strategy and business priorities of those organizations.

According to McKinsey (2013), important questions should be asked, such as:

- What will be necessary to surpass the client’s expectations on a digital world?

- Our business plans reflect the total potential of technology in order to enhance our performance?

- How is technology going to influence and change the foundations of competitiveness in every industry?

- How will technology enhance our operational and strategic agility?

In order to better adopt the available technological innovations some dimensions have taken a huge relevance, such as IT governance models, or investment alignment with business development strategies in the organizations (Sambamurthy and Zmud 2010). Management best practices must be applied and regularly reviewed, whether in business processes or in the implementation of solutions based on technology in order to maximize return on investments and business competitiveness.

The alignment of Information Systems with the business objectives of an organization is a subject of the upmost importance, but it is not always given its real value. In general, business managers share different opinions than those defended by the CIOs regarding Information Systems, especially concerning its importance and value to the business, as well as the necessities for investment. If this is already a reality in current investments and with regular support to the operation, bigger the difficulty when considering investments in disruptive innovations, for the decision-makers opinions within each organization may be substantially different and supported by different assumptions.

The discipline regarding Corporate Portfolio Management (CPM) has been considered one of the main concerns of financial organizations CIOs. It is a practice based on decisions when supported by information or indicators obtaining the best results only when corporate behaviour and processes are aligned. Another of these examples is the model for process enhancement (Capability Maturity Model Integration) which characterizes the different processes in an organization regarding its maturity level (Starting, Managed, Defined, Quantitatively Managed, In Optimization), in the context of information systems development which supports said processes and keeps searching its own improvement.

Diverse frameworks (CMMI, CPM, COBIT, CRUDi) and the best practices have been developed and applied in the last decades always seeking to maximize the return on investment and improving their alignment with the business. Nonetheless, either great speed on technological evolution, or the massive and constant challenges that organizations are obliged to face annually have directed the methodological evolution as well as best practices to more agile and better supported on real time information, which is produced inside the organizations (B&IT, 2014).

Multiple organizations have yet adjusted their structure and internal organization, giving more relevance to their CIO and putting him on an evaluator role for innovation, whether this is technology innovation or business innovation and in sync with the CEO, or in some cases, assuming the position leadership (Gartner, 2012). In equal terms the Chief Marketing Officers which often propose investing in innovating products make part of this triangle of influence, which as time goes by keeps gaining more power on the true direction of the strategy and future of an organization.

The incorporation of innovation on organizations is simultaneously a necessity and a risk which requires substantial changed in today’s organizations in order for those to achieve success and which frequently means reinventing their business models, hence, embracing the inevitable change.

| Jorge Pereira, CEO Infosistema |