Instant Digital Onboarding – A New Reality, Part II

(4-minute reading)

Implement a New Digital Onboarding Process

The decision to implement a new Digital Onboarding Process that requires a high level of security and low risks requires a revision to the overall Business Architecture.

The key success factors that a new business architecture must address are:

1. Step #1 – Customer Experience is one of the most important factors of the onboarding process. The customer journey must be rethought and simplified, and the use of Design Thinking methodologies should be adopted to clearly identify the simplest process possible and to reduce the number of interactions or touchpoints, allowing the customer to choose in real-time their preferred channel to use and when to use it. Prototyping and co-creation can also be addressed in order to improve the experience. The final solution must provide the best emotional experience possible in order to be referred by customers to friends and family as a highly desired service. The incorporation of feedback is mandatory in current solutions, so that they can keep evolving according to the audience’s best interests and expectations. An introductory step (#1) can take from one to eight weeks’ time to define and deliver the customer journey(s), using Design Thinking methodology (consultancy services).

“Silicon Valley is coming and if banks don’t up their game, then tech companies will take over the industry’s business. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking”

— Jamie Dimon, Chairman, President and CEO of JPMorgan Chase

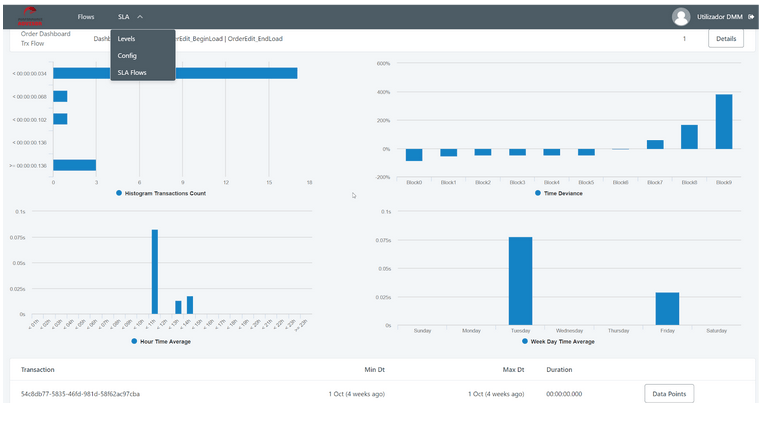

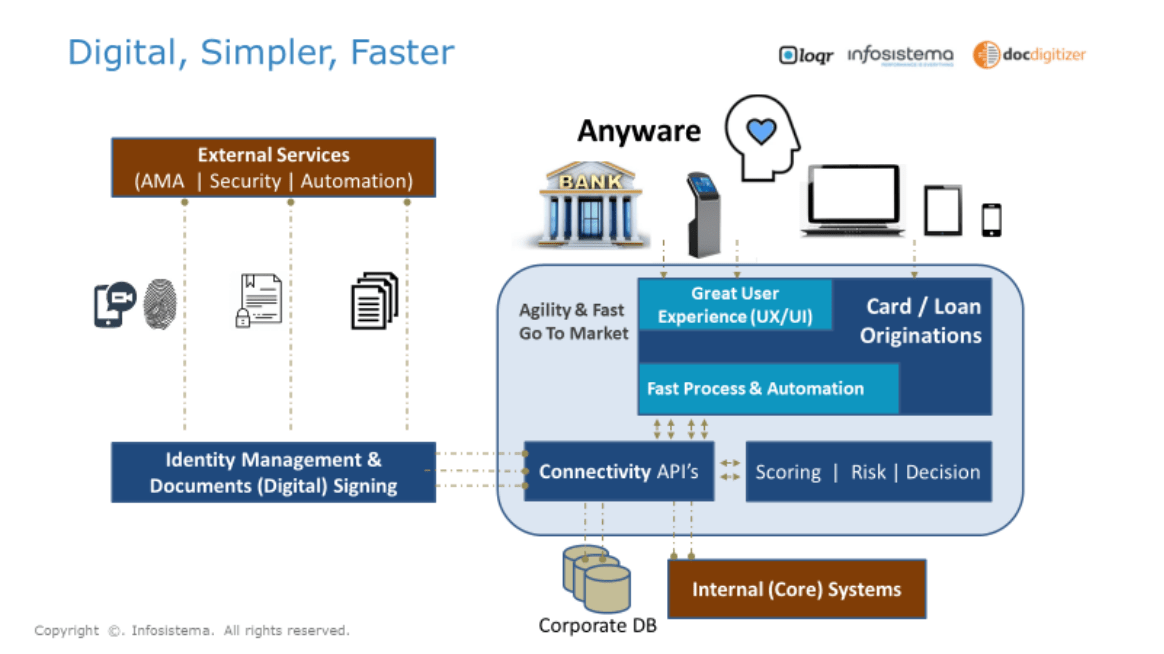

2. Step #2 – The technology and business architecture must address all specific needs for security with a low level of risk in the simplest way possible. Video call, voice recognition, and digital certificates (digital id) are available today and must be introduced in the innovation process in order to provide an integrated remote onboarding process and deliver security. A change in compliance procedures must be addressed with the introduction of new technology that replaces current manual and face-to-face identification procedures. Today’s technology allows for a much more secure identification process at a lower cost, while also being available 24×7. Additionally, all European citizens have access to an id card with digital information that can be (and should be) used to simplify and automate customer identification during the onboarding process. An IT project (Step #2) to address all Technical dimensions can take from two to five months’ time, adopting low-code and external providers with SaaS dedicated technology-based solutions. Some specific steps of the digital onboarding process require different available technologies/providers like:

I. Identification documents – Digital id reading from id card and OCR for automatic (AI/ML for multi-lingual and format/country) data structuring from documents (paper or pdf);

II. Anti-impersonation steps – Facial recognition and/or voice recognition, plus proof of life;

III. Customer’s identity verification & compliance (KYC – Know Your Customer) – All financial compliance requirements must be verified, namely to prevent potential risks like AML/CTF (Anti Money Laundry / Counter-Terrorism Financing);

IV. Electronic signature – Remote signing for contracts is available using electronic signatures with the same legal power as manual handwriting.

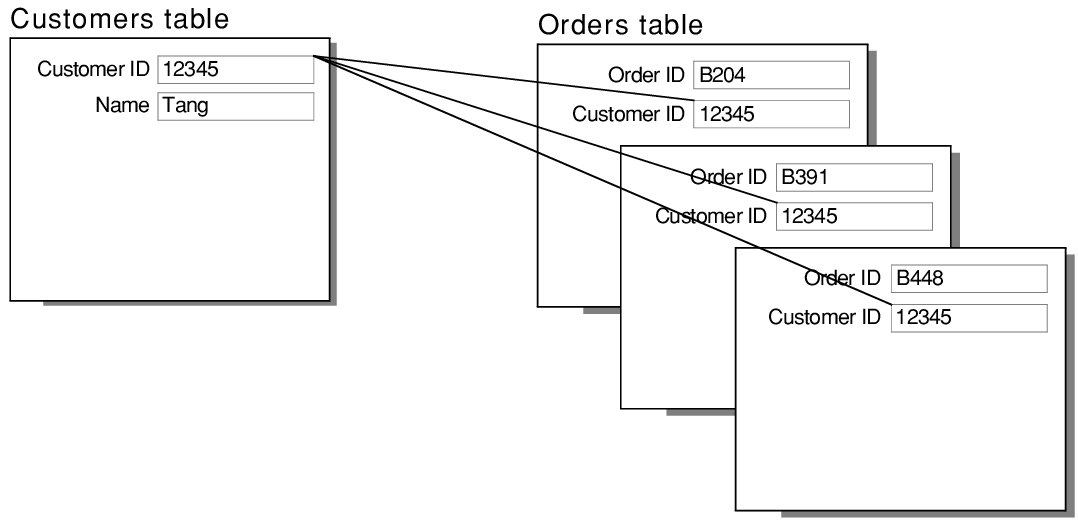

V. Orchestration and automation with multiple technologies – In order to provide a seamless experience to customers, orchestration is mandatory. A real-time digital onboarding process is not trivial and requires different pieces of state-of-the-art technology that must be perfectly integrated, including front-end (fast & perfect, with Low-code); capture ID information; OCR on documents (with AI/ML); photo/video/voice recognition; KYC & AML/CTF compliance; Risk & Scoring automation in Decisions and Electronic Signatures; and API’s to internal Core Systems (SOA). The good news is that almost every piece of those technologies can be acquired externally, as a service, without the need for internal custom development and its complexity (also cost & time). The adoption of a low-code platform and introduction of high flexibility is needed to support a fast change, delivering the user interfaces both for web and mobile at the same time. The integration with core systems must be addressed with a well-defined SOA architecture to isolate different technologies and support high evolution speeds, delivering the flexibility that business demands.

“At least 40% of all businesses will die in the next 10 years… if they don’t figure out how to change their entire company to accommodate new technologies"

— John Chambers, Cisco

3. Step #3 – Technology investments do not represent the most complex and time-consuming part of digital onboarding projects. As financial services companies grow and the regulatory pressure stacks up, compliance/operations teams have grown to match. The knee-jerk reaction to alleviate pressure on business units being swamped by increasing workloads is to add staff, not technology. This does not scale. It all amounts to a larger set of moving parts that become harder to manage.

“The biggest impediment to a company’s future success is its past success.."

— Dan Schulman, CEO of PayPal

Many regulations must be addressed and supported like KYC, AML, or GDPR. All the financial regulations that apply must be carefully analyzed before launching the new digitized process. These efforts include the internal process changes that are needed to automate and improve efficiency, as well as the touchpoints with the customer and their information, in a new digitized context. Compliance requirements must be addressed and adapted to the digital new reality, followed by explicit approvals from regulators, so they can be incorporated in standard business practices. All interactions with external entities can take some time and may address specific differences in different countries. In order to get a faster path on compliance approval for the new digital business practices, financial providers should begin with this parallel project right from the beginning, keeping in mind that it can take from one to three months’ time and can start after the customer journey definition (Step #1).

As a guiding reference, we can identify the following overall time to value:

Step #1

One to eight weeks

Base Line: 1 month

Step #2 + Step #3

Two to five months

One to three months

Base Line: 4 months

Overall Time to Value

Three to seven months

Base Line: 5 months

Thirsthy for Knowledge? Subscribe to our Newsletter and Never Miss Another Byte!

Previous Part: Credit and AI: the future for Loan Origination in 2019