Top 3 Benefits Organizations Can Get from Open Banking

What can you get from Open Banking? Top 3 Benefits You Want to Know

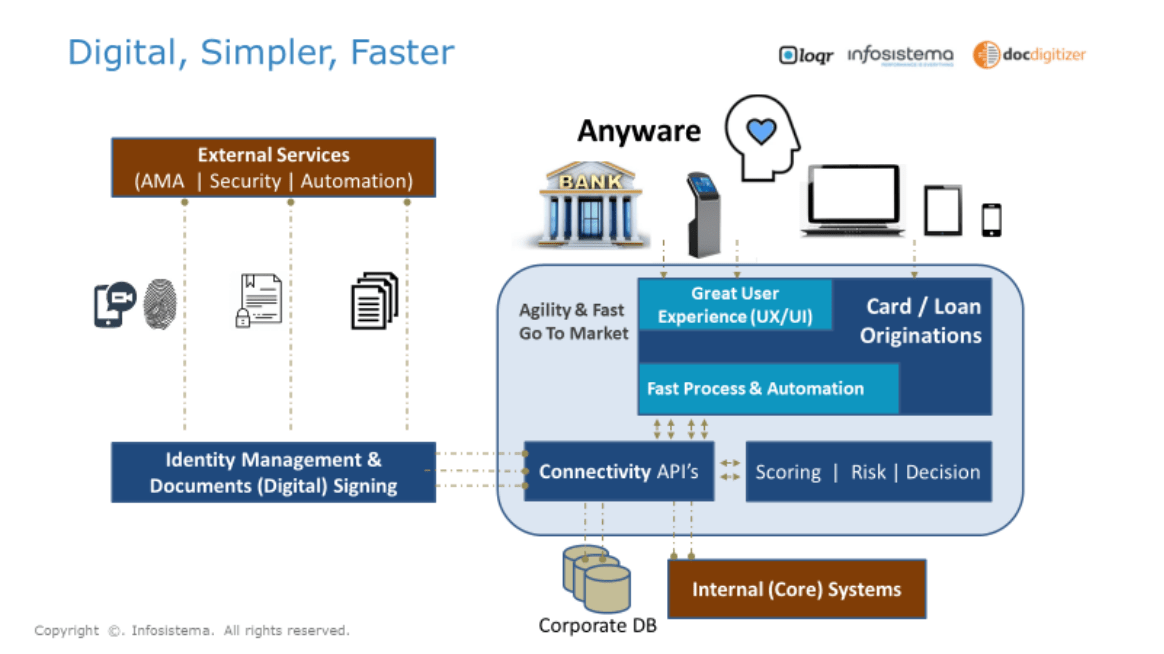

Open Banking is a new way of thinking, bringing the opportunity for a rebirth of the financial industry. FinTech companies (by definition) are willing to take some risks – to introduce new concepts and business models – backed up by investors. Until now, incumbent banks have led the financial industry, but the moment has come for challengers [1] to make their move and start using new Open API’s that PSD2 (Second Payment Services Directive) made available in Europe last March.

The PSD2 brings additional technology availability to the financial ecosystem along with a huge opportunity for corporations and economic groups to automate and robotize several financial functions related to cash management and cash flow forecasting. If you’re the Chief Financial Officer (CFO) of an economic group, you’ll be able to access and monitor, in one single place and in real-time, all bank accounts of all companies that belong to the group. This way, CFO’s and treasurers can optimize their short-term investments when there’s excess cash available or ensure cash buffers (serving as an early warning system) for potential cash shortfalls.

How to ensure high standards in cash flow forecasting?

According to best practices [2], treasures should consider three dimensions:

- Focus on both short-term and medium-term forecasting – update your 30 day forecast on a daily or weekly basis and your yearly forecast on a monthly basis. Financial predictability is key for the survival and healthy growth of organizations;

- Automate everything as much as possible – more than 50% of companies cite a lack of automated tools as the key challenge to forecasting activities. With automation and interoperability between financial systems consolidating different inputs of information, organizations can reduce risk significantly and achieve improvements on accuracy and reliability;

- Review cash flow forecasting variances daily – treasurers should analyze and compare their actual versus projected forecast (variance) on a daily basis. Technology and a simplification mindset can make this possible with reduced budgets.

If you would like to understand how to automate and improve the accuracy of your forecasts, please get in touch.

[1] Source: First Principles of Investing in FinTech, Greylock

https://news.greylock.com/first-principles-of-investing-in-fintech-50dd10d437dd

[2] Source: J.P. Morgan’s View: Best Practices in Cash Flow Forecasting, J. P. Morgan

https://www.thecorporatetreasurer.com/article/j-p-morgans-view-best-practices-in-cash-flow-forecasting/442504

Written by Jorge Pereira

CEO & Partner @ Infosistema, 2019.06.21